Written By Troy Corman

As the US government pledges unprecedented spending to fight off the Coronovirus illness affecting lives and US businesses, it will be interesting to see how the long-term ramifications unfold.

I’ve seen two opposing opinions. The first response is that long-term, this is more money flooding into the economy, which coupled with expected very low interest rates for some time, will fuel more of the runaway price appreciation that we’ve experienced over the last ten years. The government will be further motivated to keep interest rates low one would think, as they take on trillions of additional debt on their balance sheet. In general, as interest rates decrease, real estate purchase demand increases, along with prices.

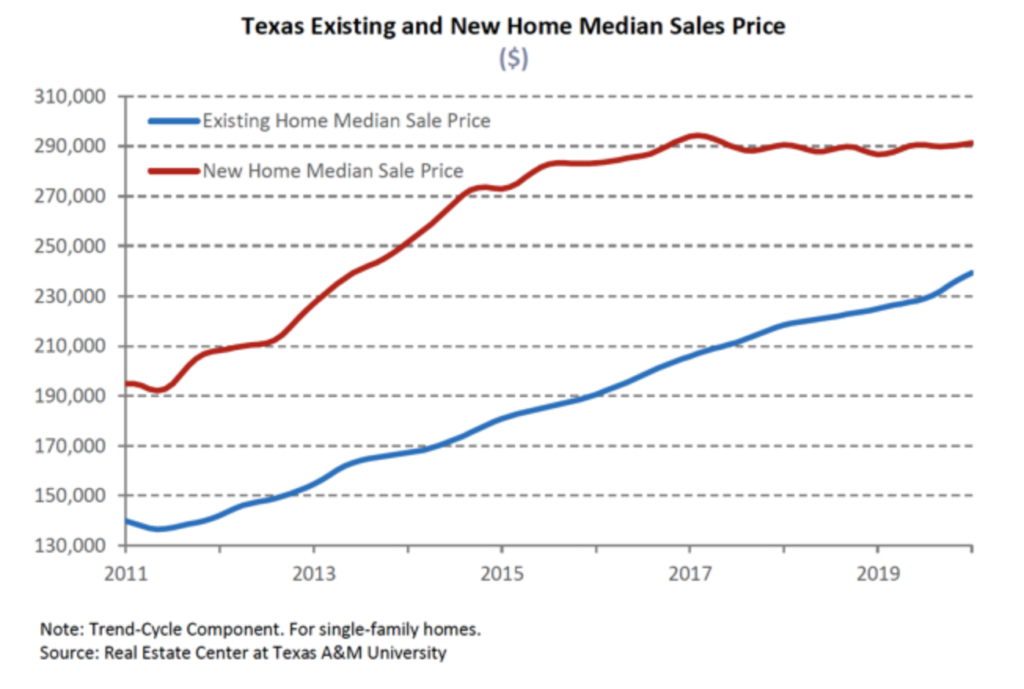

With so much debt, another motivation would be to devalue the dollar, which thus, reduces the debt burden. This would naturally lift asset prices and real estate prices across all sectors to a degree. I watched some of Jerome Powell’s speech after this latest round of stimulus was announced, and always marvel when he says, in essence, we have less inflation than we would like. That is certainly not the case when you look at mankind’s most expensive need – shelter. As an example, over the last ten years, Dallas apartment rents, and Texas median new home prices have increased 60% and 66% respectively. Meanwhile, the median income in Dallas has increased 32%.

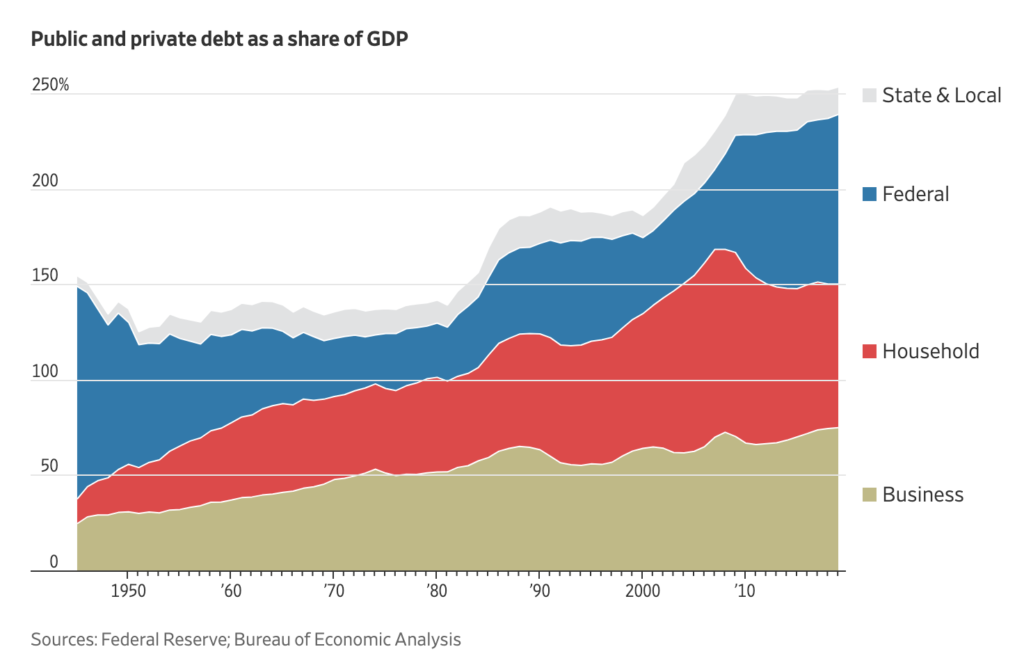

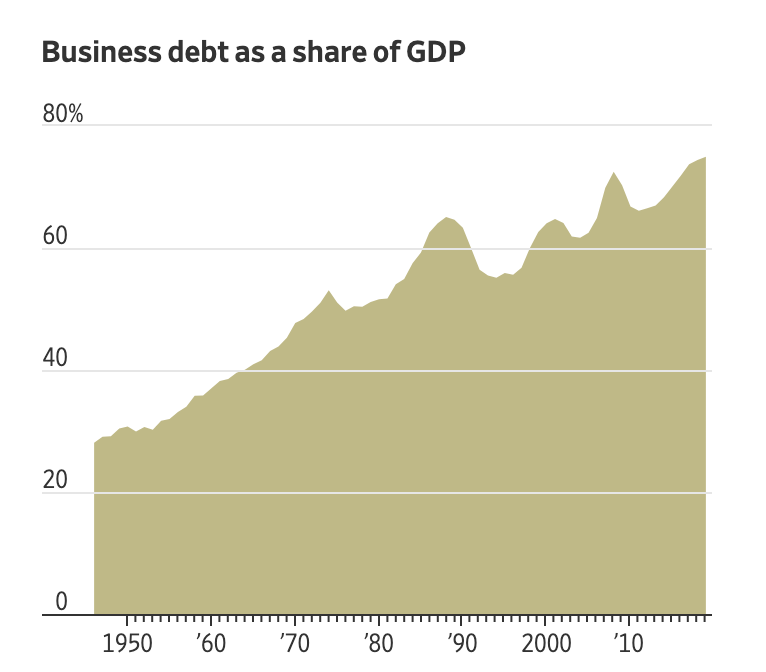

The opposing argument is that individuals and businesses will spend less as they pay down debts built up over the economic shutdown, and build up larger savings to offset the economic pain they’ve endured. Business and individual debts are at all-time highs, with federal debts increasing at alarming rates. Higher taxes, or more taxes and fees, are certainly in the cards, as there may be no other choice.

Personally, I believe that the combination of the stimulus and low interest rates will spur rising prices and more inflation.

Below are just a few of the ways to fight inflation with real estate investing.

Ranch and recreational land is an investment you can enjoy and use for recreation, business use or shelter. The benefits of investing in recreational land is that generally the property taxes are very low, compared to urban areas, and you can enjoy time in nature with friends and family. There is also the chance that you might make money on mineral leases or easements. Many choose to buy recreational land a few years before retirement, so they can enjoy it and then build a new home once they’ve officially retired and escaped the city.

Commercial real estate investments can provide streams of income and accelerated depreciation, which greatly reduces your income taxes, particularly if you’re categorized as a real estate professional. Then, you can write off “paper losses” on your other earned income.

Some of the most successful real investors I know have bought land, rental homes, duplexes and small apartment buildings in the urban core. They really get massive property appreciation during the real estate booms, particularly if their properties are in the path of development.

Demographically, there is still a massive demand for first-time homes. The millennials are putting down roots and are the main driver of home sales. In the immediate term, the lack of housing will continue to drive real estate development, home building and land purchases, particularly, once the economy gets fully rolling again. Let’s just hope it gets rolling sooner, rather than later.

Stay safe.