By Troy Corman, t2ranches.com

As the low interest rate environment has continued following the Great Recession, most real asset prices have appreciated greatly, including recreational and agricultural land. Now, more than ever, it’s important to employ property tax reducing strategies to offset the higher property values. One way to do this on vacant raw land is to have the land legally deemed as Open Space (1-d-1) or Ag-use (1-d), as described in the Texas Constitution in Article VIII, Sections 1-d and 1-d-1. In this article, we will be discussing how Ag Use and Open Space land in Colorado County can qualify. If you would like to know how open space land and ag land designations work in your county in Texas, we will be happy to research and provide the answers.

The Open Space and Ag Use designations are special valuations that tax land on its agricultural use, or productivity value. There are specific requirements that must be met to qualify for either designation as detailed below.

Ag Use (1-d)

The land must be owned by a natural person. Partnerships, corporations or organizations may not qualify.

The land must have been in agricultural use for three years prior to claiming the Ag Use valuation.

The owner must apply for the designation each year and file a sworn statement about the use of the land.

The agricultural business must be the land owner’s primary occupation and source of income.

Open Space (1-d-1)

The land may be owned by an individual, corporation or partnership.

The land must be currently devoted principally to agricultural use to the degree of intensity generally accepted in the area.

The land must have been devoted to a qualifying use for at least five of the past seven years.

Agricultural businesses may not be the principal business of the owner.

Open Space is the most common designation. Keep in mind, both agricultural valuations have nothing to do with the market value of the land. Instead, the taxable value is based on the productivity value of the land. (PTC Sec. 23.52 Appraisal of Qualified Agricultural Land). One way to qualify for the Open Space valuation without having to wait for five years, is to have the land devoted principally to wildlife management, as defined in Subdivision (7)(B) or (C) to the degree of intensity generally accepted in the area, regardless of how the land was used in the preceding year. The caveat is that this is only allowed if your land is in an area with Federally Endangered Species, like the Golden-Cheeked Warbler, or the Black-Capped Verio.

Intensity Standards for Open Space Land

Intensity standards are derived from what is typical in the local area for the different agriculture operations. To qualify for Open Space land in Colorado County, the tract must have at least 70% to 75% agricultural use to qualify the entire tract, and must be used as such for a minimum of six months a year. The uses are defined in the following categories.

Cropland Operations

Row Crop

Orchard

Hay Crop

Truck Farm

Vineyards

Irrigated Cropland

Grazing Operations

Improved Pasture

Native Pasture

Brush Land

Wasteland

Special Operations

Dairy

Feedlot

Hop Operations

Bee/Honey

Permaculture

Floriculture

Domesticated Fowl

Christmas Trees

Aquaculture

Turf Grass Farm

Timber

Minimum Trees Per Acre Requirements

Pecan Orchards 14 trees/acre

Peach Orchards 40 trees/acre

Timber 400 trees/acre

Christmas Tree Farm 700 trees/acre

Minimum Acreage Requirements for Land

Native Pasture 10 Acres Minimum

Improved Pasture 10 Acres Minimum

Hay Production 10 Acres Minimum

Orchards/Vineyards 10 Acres Minimum

Tree Farms 10 Acres Minimum

Grass Farms 10 Acres Minimum

Irrigated Crop 10 Acres Minimum

Aquaculture 10 Acres Minimum

Previously, the minimum acreage was 6 acres, which is grandfathered in, but if you sell land or pass land on to heirs, the 10 acre minimum goes into effect.

Example of Tax Savings With Ag Use or Open Space Designations

In the following example we will consider a 15-acre tract of land in Colorado County appraised at $10,000 per acre, for a market value of $150,000.

Columbus ISD Tax Rate = $1.15/100 = .0115

Colorado County Tax Rate = $0.51/100 = .0051

CO Groundwater Conservation District = $0.01/100 = .0001

Total Tax Rate for the property is $1.67/100 = ./0167 ($1.67 per $100 of appraised value)

Without an Ag-use or open space use, this land would normally be taxed at $1.67 x $150,000 (the appraised value in this example) resulting in a property tax bill of $2,505.

If this same 15 acres was classified as “Ag Exemption” based on cattle grazing (Native Pastureland as the category), you would multiply the $150,000 x $98 (Colorado County appraisal district ag value for native pastureland). The result would equal $1,470.

Now the annual property tax would be calculated multiplying the $1,470 x .0167 (tax rate of $1.67/100), to arrive at a property tax bill of $24.55. That’s quite a difference!

How to Get Your Land an Ag Exemption in Colorado County

The new property owner(s) must apply for the Ag Exemption and must have owned the property on January 1 of the tax year. The property must have had an ag exemption in the previous tax year and must be at least 10 acres. Once the property transfers to the new owner(s), the Appraisal District must send them an application to continue the ag exemption.

If the property is bought after January 1 in which the previous ag exemption is in place, the new owner will keep the benefit of the ag exemption for that tax year.

For an existing land owner that has never received an “Ag Exemption”, the land must measure at least 10 acres, must be currently devoted principally to agriculture use to the generally accepted standards for the county, and must have established agricultural use for five out of the preceding seven years. An ag application must be filed with the district with the Chief Appraiser before ag is granted or denied (PCTS Sec. 23.54. Application)

The 1D1 Open-Space Valuation (Ag Exemption) application is due before May 1st.

Beekeeping is Now a Qualified Ag Exemption for Tracts as Small as 5 Acres

On January 1, 2012, Texas law made is possible for beekeeping to qualify as an ag exemption on property taxes. The details can be found in the Texas Property Tax Code under chapter 23, Subchapter D, Sec. 23.51 (1) and: (2) “… the term also includes the use of land to raise or keep bees for pollination for the production of human food or other tangible products having a commercial value, provided that the land used is not less than 5 acres or more than 20 acres. The Colorado County Appraisal District allows for pollinating-solitary Nesting Bees (typically Mason Bees – bees of pollination) or Honey Bees (production of human food).

Under Open-Space productivity valuation, values are calculated using a modified income approach to determine the value per acre.

In Texas, one hive is estimated to produce 74 pounds of honey, with an estimated $60 of expenses per hive. Utilizing the five-year average of $5.08 per pound of honey, Colorado County calculates the Beekeeping valuation as follows:

-

- Five-year average of net to land = $315.92

- Capitalization Rate = 10%

- Gross Productivity Value ($315.92/.1000) = $3,159.20

- Maximum hives per Max Acreage = 0.6 x (12hives/20 acres)

- 20 acres contribution to total bee range = 17.68%

- Productivity value $3,159.20 x .1768 = $335.13, rounded off to $335 per acre

Intensity Standards for Beekeeping in Colorado County in Texas

5 acres – must have 6 hives or nesting boxes

6 – 10 acres – must have 7 hives or nesting boxes

11 – 12 acres – must have 8 hives or nesting boxes

13 – 14 acres – must have 9 hives or nesting boxes

15 – 16 acres – must have 10 hives or nesting boxes

17 – 18 acres – must have 11 hives or nesting boxes

19 – 20 acres – must have 12 hives or nesting boxes

How to Qualify for Wildlife Management Use for an Open-Space Agricultural Valuation to Reduce Your Property Taxes in Texas

To qualify for Wildlife Management Use, the land must have been qualified as Ag Open Space use previously for at least one year. The land must have been used in at least three of the following ways to propagate a sustaining breeding, migrating, or wintering population of indigenous wild animals for human use, including food, medicine, or recreation:

- Habitat control

- Erosion control

- Predator control

- Providing supplemental supplies of water

- Providing supplemental supplies of food

- Providing shelters, and

- Making census counts to determine population

If the new owner has subdivided the land out of a larger tract, then the tract must be a minimum of 16 acres to qualify as Wildlife Management Use. The new owner can wait one year under ag exemption, and then switch to Wildlife Management use.

If the tract had Wildlife Management use in the previous year, and meets the minimum 10 acres for Ag Exemption, then the new owner can continue using Wildlife Management use but a new 1D1 Ag Application must be submitted along with a Wildlife Management Plan. The Wildlife Management Plan can be on the Texas Parks and Wildlife Form 885, or can be a self-written plan, but it must include three out of the seven wildlife practices listed above with a list of targeted wildlife species.

It is recommended that you provide a map of where the three practices are located on your land. In addition, keep your receipts for your expenses incurred as a result of actively maintaining the three out of seven wildlife management practices. Ideally, you will want to contact your local Texas Parks and Wildlife (TPWD) Biologist prior to filling out the wildlife management plan. The Biologist can also advise you on what wildlife is conducive to your particular property.

Ag Rollback Taxes in Texas

Be aware that if you sell land that has either the Ag Use or Open Space designation, rollback taxes could be triggered. An Ag Rollback Tax is an additional tax that is imposed when a property owner changes the use of a property from Agricultural to any other use – excluding building a house for a personal homestead. The Rollback Tax recoups the tax the owner would have paid if his or her land had been taxed at Market Value for the years covered in the Rollback (generally five years).

Under Ag Use (1-D), sale of the land or the change of use in the land creates the Rollback Tax which extends back to the three years prior to the year in which the sale or change in use occurs.

Under Open Space (1-D-1), the Rollback Taxes are triggered when the change in use is for a nonagricultural purpose, with taxes rolled back to recapture the previous five years of taxes that would have been paid had the land not had the Open Space designation.

If you have any questions regarding any details in this article, or need additional information, please contact Troy Corman, founder of t2 Ranches, at 832-759-1523 or 214-690-9682.

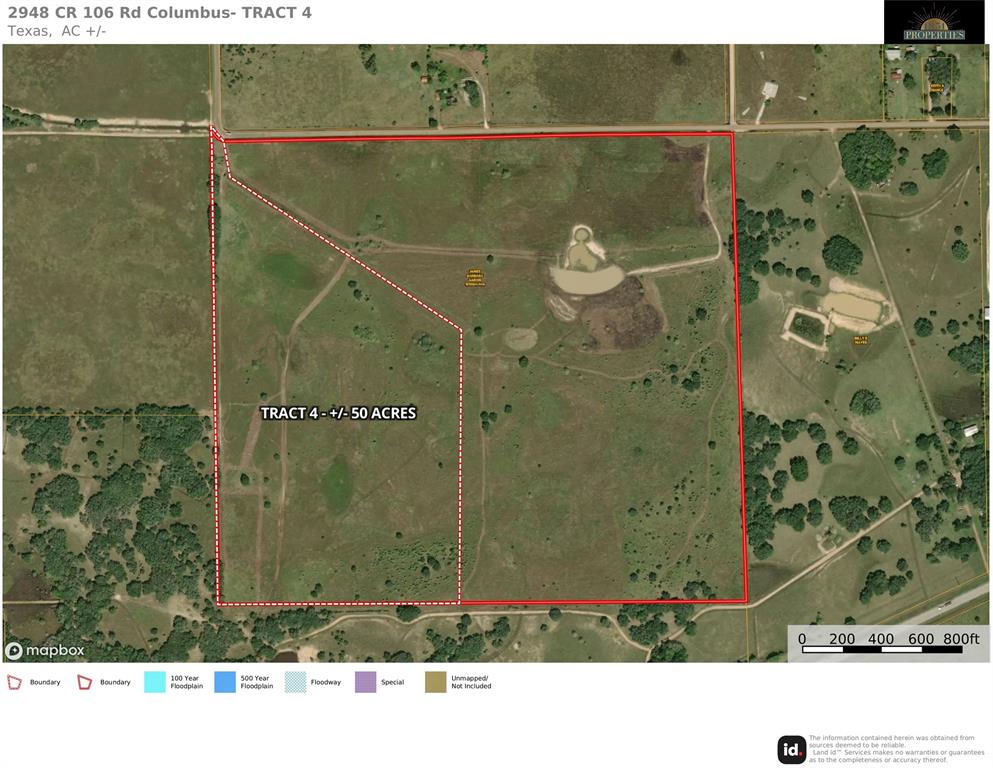

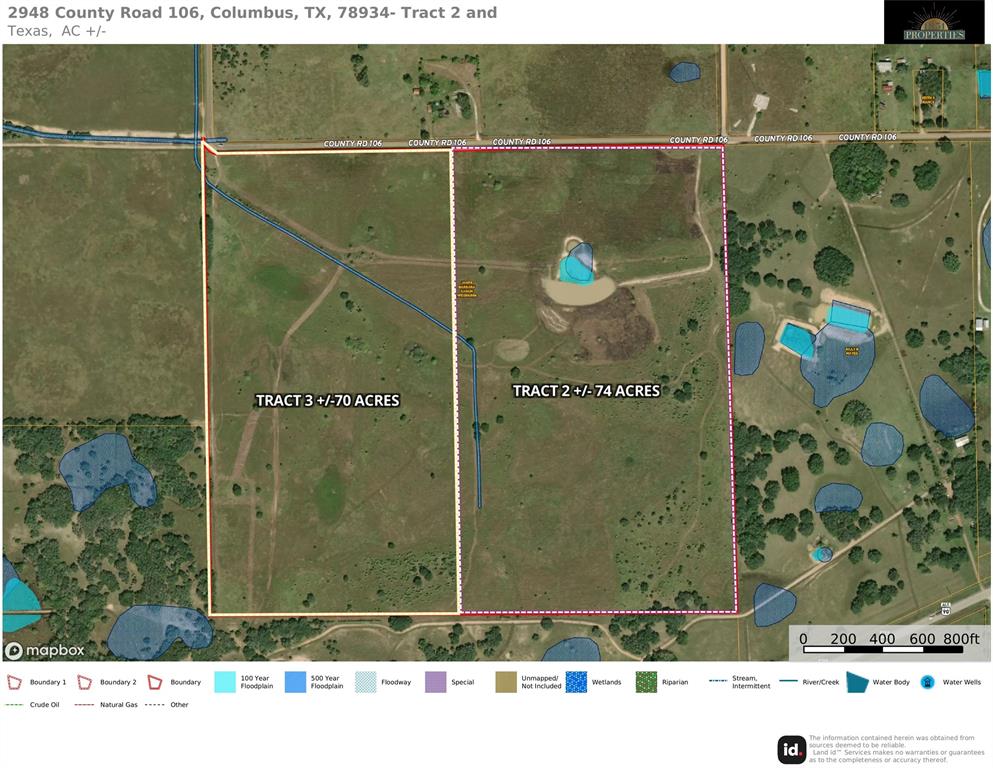

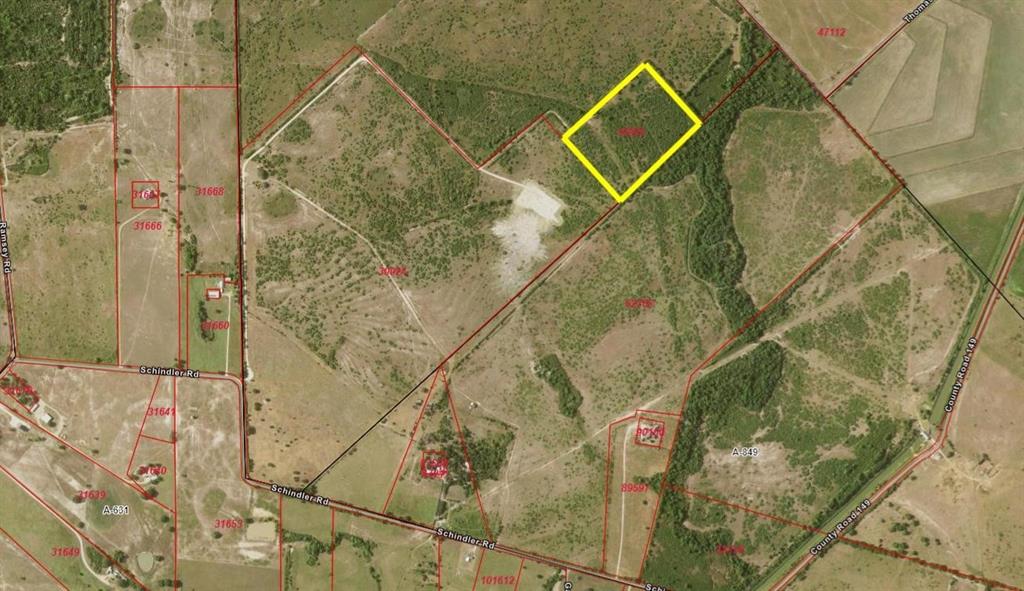

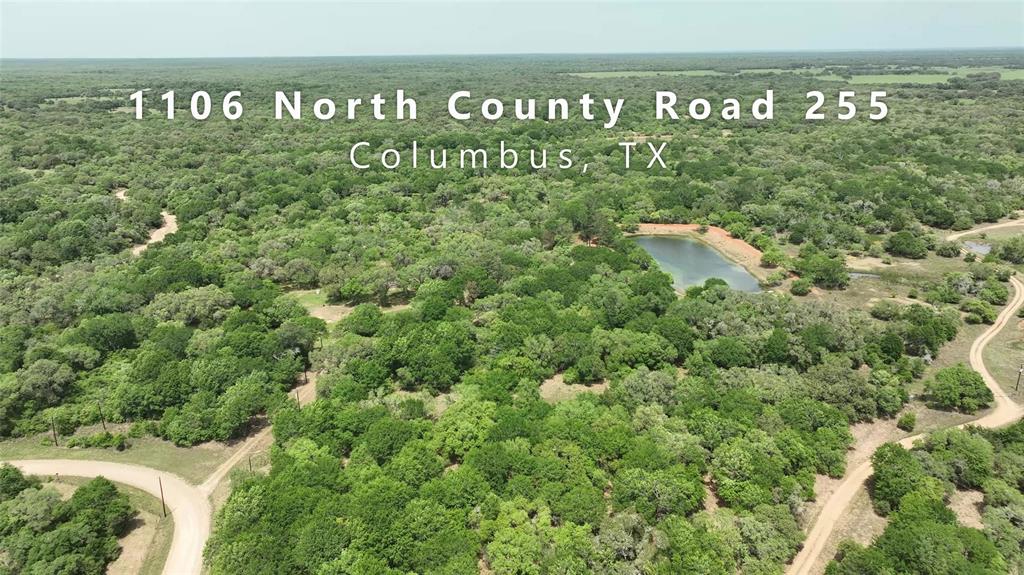

Land and Ranches for Sale in Colorado County, TX