DR Horton purchases 157 acres in Sealy TX. Troy Corman with t2 Real Estate brokered the sale.

Contact us if we can assist you with buying or selling property.

Your Texas Land Guide

DR Horton purchases 157 acres in Sealy TX. Troy Corman with t2 Real Estate brokered the sale.

Contact us if we can assist you with buying or selling property.

By Troy Corman, t2 Real Estate / T2 Ranches

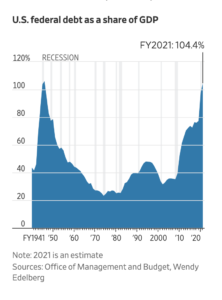

An alarming article by the Wall Street Journal indicated that the US debt will exceed the US Gross Domestic Product (GDP) in 2021. In fact, they forecast it to reach 98% of GDP this year. The combination of lower tax receipts and the $3.3 trillion pledged since March, to combat the effects of the coronavirus, have pushed the debt from $17.7 trillion in March to $20.5 trillion at the end of June. Next year will be the first time that the federal debt has exceeded GDP since 1946, when the US was financing military operations to end World War 2.

Surprisingly, ultra-low interest rates so far have resulted in net interest costs on the debt to be 10% less than a year ago, despite the increased debt load. Economists are now forecasting even lower interest rates in the years ahead, but expect the interest on the debt to cost $1 trillion annually by end of the decade. They also are forecasting low inflation, which I always find laughable, when you look at how much real estate values have increased during these “low inflation” years.

The low-interest rates have been jet fuel for home purchases and a rapidly rising stock market, although the market’s had a couple of rough days most recently. If interest rates remain incredibly low, and the “new norm” for the next several years, when do they become less of a booster for the real estate and stock markets, as they become taken for granted?

What will the US then be able to do, to spur the economy during downturns when interest rates can’t go any lower? I certainly have no idea, but increasing taxes, or reducing government spending, are two ways to whittle away at the debt, and the most painful for politicians. More likely, in my humble opinion, they will let the value of the dollar decline whenever possible, thus monetizing the debt. This, in turn, will make hard assets, like real estate increase in value.

It will be interesting to see how it all plays out.

Troy Corman has had a real estate brokerage practice since 2009, and focuses on land sales surrounding Houston, Dallas – Fort Worth and Austin TX. Reach him at 214-690-9682 or 832-759-1523.

Article by Asher Elbein, Texas Observer

When the rain began, the antelope and deer of the Y.O. Ranch Headquarters gathered to chew idly beneath the sparse trees. For 10 days in October 2018, a line of storms pounded the Texas Hill Country. Brown currents rose over a bridge on the ranch, spilling out over the roads and gullies of this 14,000-acre property 140 miles west of Austin. The flood tugged at the 8-foot fences around the ranch until it finally pulled them down.

That was when the kudu made their move, disappearing through the fallen perimeter fences on the ranch’s border. Native to Africa, the kudu is a brown-and-white-striped antelope species with long spiraling horns. The Y.O. Ranch population was ready for life on the lam. By the time ranch hands managed to repair the fences and conduct an animal count, virtually the whole herd—20 of 26 kudu—had escaped. Read the full article on Texas Observer

When Danelle and Ron Reimer moved to Austin, Texas, from Orange County, California, Last month they were intrigued by its “big little city” feel.

“We’re not really city people, but we love how welcoming Austin feels and how easy it is to get to know and to get around in,” said Danelle Reimer. “We bought in the Seven Oaks neighborhood because it’s close to downtown but also has privacy and views.”

The Reimers ’ 9,000-square-foot house, which they purchased for more than $2 million, reminds them of a Southern California-style home with its arched doorways, tile work, wood beams and stonework.

“We like a lot of space and this house has a lot of personality, too,” Ms. Reimer said.

The Reimers, who relocated for Ron’s work with a global financial services company, aren’t the only high-net-worth family to make the “Texas Triangle,” which includes Houston, Dallas and Austin, their home in recent years.

More: Tuscan-Style Estate in Texas To Hit Auction Block Next Month

The Dallas-Fort Worth-Arlington metro area is ranked 10th in the world on the list of top locations for the ultra-wealthy, according to the 2019 Wealth Report from Wealth-X.

Among the ZIP codes with the highest median sales prices in the Triangle this year, according to realtor.com, are the 75225 ZIP code in Dallas, where the median sales price year-to-date through August 2019 was $1.22 million, an increase of 4.1% compared to that same period in 2018. In Houston, the median sales price in the 77005 ZIP code from January through August 2019 was $1,1 million, an 8.3% increase compared to that same period in 2018. In Austin, meanwhile, the median sales price rose 2.2% to $830,000 in the 78746 ZIP code, the highest median sales price in that city.

(Mansion Global is owned by Dow Jones. Both Dow Jones and realtor.com are owned by News Corp.)

From Penta: Christie’s to Offer Two Pairs of Chairs Designed by Frank Lloyd Wright

Buyers Entering the Texas Triangle

Northern California is a big feeder market for the luxury housing market in Austin, said Gary Dolch, owner of the Austin Luxury Group with the Compass real estate brokerage in Austin.

“These buyers were often originally dipping their toes in the water and buying a second home in Austin after they’d been here for South by Southwest or another tech event,” Mr. Dolch said. “Now they’re moving here full time.”

It helps that Texas doesn’t have any state income tax, Mr. Dolch added.

“One guy told me he got the equivalent of a 36% raise just by moving from California to Texas because of taxes,” Mr. Dolch said.

More: Once Asking $8.9 Million, an East Texas Ranch Hits the Market for Half Price

Austin attracts people from Chicago, too, according to him, either members of the tech industry or retirees who want to escape winter but be able to fly back regularly to see friends and family.

And “in the last 12 months, we’ve also seen more venture capital guys and developers from New York move to Austin to build businesses here,” Mr. Dolch said.

North of Dallas, particularly in the Frisco area, top executives from major corporations like State Farm, Liberty Mutual and Toyota are moving in along with their companies, said Russell Rhodes, a real estate agent with Berkshire Hathaway HomeServices PenFed Realty in Flower Mound, Texas, near Dallas. In other neighborhoods around Dallas and Fort Worth, multimillion-dollar properties are mostly purchased by business owners, tech company leaders, oil and gas executives, professional athletes and some relocating Californians, Mr. Rhodes said.

“Dallas is a growing city,” said Rhodes. “People like it that you can get a place with land and water views and yet be close to the city and its cultural amenities.”

More: NFL Hall-of-Famer Terry Bradshaw Lists Longtime Ranch in Oklahoma

In Brenham, a community of ranches and vacation homes that’s about one hour from Houston and two hours from Austin, most of the luxury property buyers are locals who want quick access to those two cities, said Tanya Currie, a global luxury agent with Coldwell Banker Properties Unlimited in Brenham, Texas.

“Both Austin and Houston have seen good economic growth, which has brought in successful business owners,” Ms. Currie said.

She added that Texas politicians are also buying vacation homes in the area for weekend entertaining with close proximity to the cities.

“The luxury buyers in the Brenham area are what we call ‘weekend ranchers’ who want 50 to 200 acres,” said Kelli Brennan, vice president and chief operating officer of Coldwell Banker Properties Unlimited in Brenham. “The majority are cash buyers. Some are oil and gas executives, some are business owners, and a lot of them are investors from California and New Mexico who are building custom homes and then selling them in a few years.”

Buyers who keep cattle or bees or grow hay on their property may be eligible for an agricultural exemption for a tax break, Ms. Brennan said.

More: Former Dell CEO Kevin Rollins Lists Luxury Ranch in Texas

Big Entertaining Space a Must

No matter which part of the Texas Triangle they’re choosing, a common theme for most luxury home buyers is space to entertain, especially outdoors.

Thomas Markle, owner of Thomas Markle Jewelers in Houston, recently purchased the 50-acre Hidden Spring Ranch in Brenham, which he said is more manageable than some of the nearby ranches with 200 or 300 acre.

“Besides our main home in The Woodlands [in Houston] I’ve owned vacation homes in Maui and in Colorado,” Mr. Markle said. “The countryside in Brenham is unique in Texas, with rolling hills, a beautiful landscape and a small-town atmosphere, but it’s only an hour from Houston. I use our house here a few days every week. I wanted a vacation home that I could go to on the spur of the moment.”

More: The U.S.’s Permian Basin is Booming and Massive Mansions Have Followed

Markle purchased his home for $1.6 million and then spent $200,000 transforming part of the barn to a full-blown cantina with a stage for bands, a dance floor and high-tech karaoke equipment. He converted an eight-car garage to a guest house and hosts friends and family around the swimming pool and outdoor fireplace.

“Buyers in the countryside in the Texas Triangle really like the luxury farmhouse style, but they also want the ranch atmosphere with lots of acreage, oak trees, big views and ponds,” Mr. Brennan said. “We recently had a bidding war on a $4.4 million property called Stone Ridge Ranch, which has 147 acres and looks like a park with seven ponds and bridges over the water.”

A smaller estate on the market now on the street of FM 1361 in Somerville includes 19 acres with a lake, a creek and an infinity pool with a spa. Priced at $1.25 million, this weekend property has back-to-back fireplaces in the approximately 3,000-square-foot custom home, along with lighting in the lake for night fishing.

More: Texas Gangster’s Gambling Den Selling for $12 Million

The Reimers’ house in Austin has an infinity edge swimming pool with a triple-height fountain pouring water into the pool, a focal point for outdoor entertaining.

“Water is a big draw in Austin because you have this great 24-acre Lake Travis and you can build alongside it,” Mr. Dolch said. “It turns into Lady Bird Lake in the city and then you also have Lake Austin. The values of lakefront property have climbed in recent years from $6 million to $8 million a few years ago to $12 to $20 million now. If you want a new construction custom home, it can be $30 million.”

For example, a 17,800-square-foot waterfront estate on Comanche Trail with 13 acres on Lake Travis, is listed at $14.9 million. The custom home, which took four years to build and was completed in 2012, includes water and sunset views from nearly every room.

This article originally appeared on Mansion Global.

Contact Troy Corman for ranch and land properties in the Texas triangle of Houston, Austin and Dallas-Fort Worth at 832-759-1523, 214-690-9682 or troy@t2ranches.com

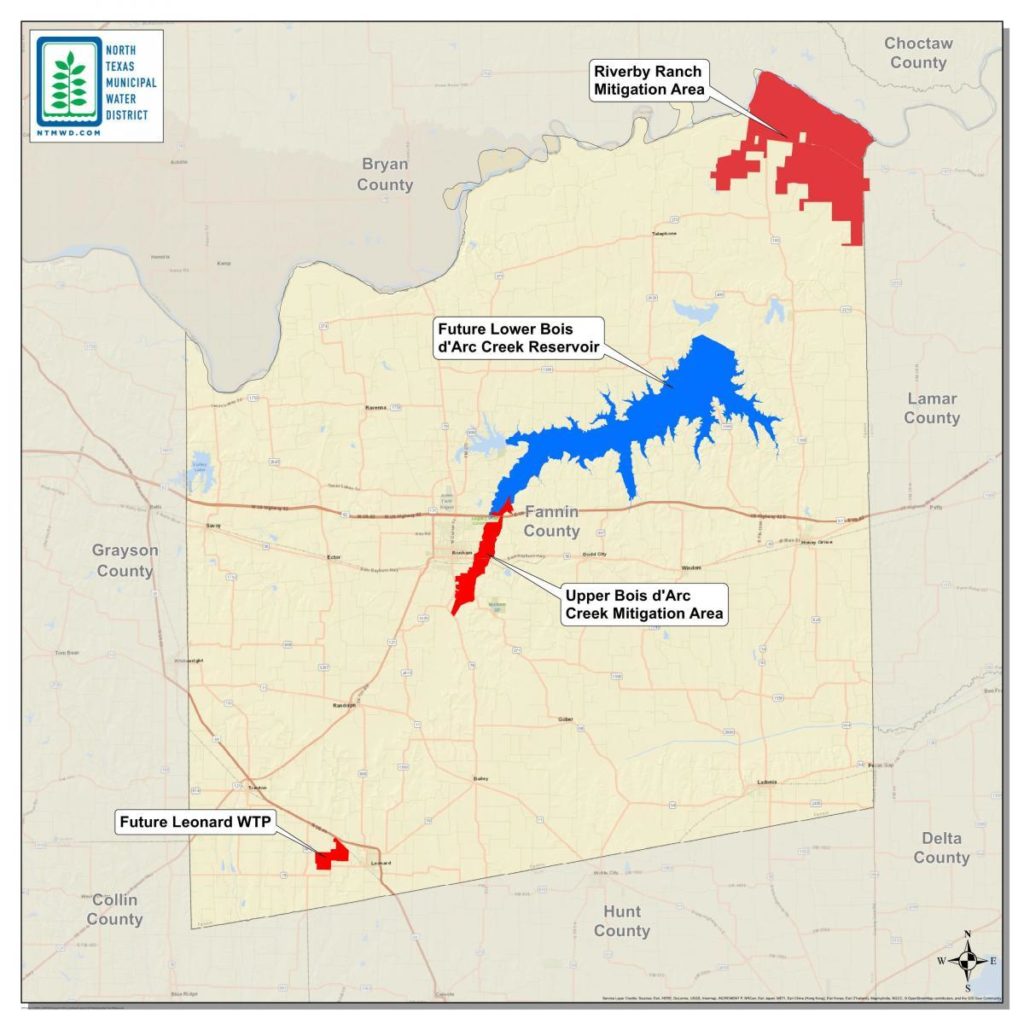

Fast-growing North Texas towns need water. But a reservoir project will displace families who have lived in Fannin County for generations.

Fast-growing North Texas towns need water. But a reservoir project will displace families who have lived in Fannin County for generations.You know you’re getting close to Harrold Witcher’s place when you pass the water tower in Carson, a community of 22 people in northeast Texas just south of the Oklahoma border. A mere 20 minutes from the Red River, this is a part of the state that’s predicated on precipitation. Folks here can count on Bois d’Arc Creek to flood several county roads at least once a year, and a chief source of recreation is fishing in one of several nearby lakes.

All that rain makes this ideal country for growing soybeans and raising cattle on verdant green pastures. That’s the line of business Harold Witcher is in.

Witcher, who also raises cattle on an additional 300 acres in eastern Fannin County—which is about an hour northeast of the water district’s headquarters in Wylie—has worked in agriculture for most of his life, he says. He credits ample rainfall for much of his success. Bonham, the county seat, sees 46 inches of rain a year, nearly double the amount the West Texas town of Abilene gets. But the rain that’s helped keep 68-year-old Witcher in crops and cattle for so long will be his undoing. With the help of a Dallas-area water supplier, Witcher’s land, along with his business, will soon be underwater.

Fannin County is the future home of the Bois d’Arc Lake Reservoir, a 26-square mile body of water that will stretch across the central and eastern parts of the county and hold 367,609 acre-feet of water. The projected cost of building the reservoir, which includes a pump station, a dam, and pipelines, is $1.6 billion. Once completed, it’ll be the first major reservoir built in Texas in nearly three decades.

Mike Rickman, deputy director of the North Texas Municipal Water District, said the project is needed to ensure the region doesn’t run out of water in the next big drought.

“We need enough supply to take us through what is the equivalent of the drought of record,” Rickman said. “In our world, that would be seven years in duration. It is a lot of water that’s needed.”

The water district, which is building the Bois d’Arc lake, plans to pipe water from the reservoir 40 miles southwest to McKinney starting in 2022. The town of McKinney, along with other suburban enclaves bordering Dallas, represent some of the fastest growing communities in the entire nation. Rickman says all those residents expect a steady source of water—but meeting the demand is a tall order.

But some residents of Fannin County, including Witcher, will pay a high price to provide urbanites with water—namely their homes and land that’s been in the family for generations.

“A lot of the people in urban areas I’ve talked to about this that were raised in the urban environment, they say, well, just go get yourself another place,” Witcher said. “That is easier said than done. You just can’t go replace something that you’ve worked at your whole life. It’s not like going and buying a new house. It’s not the same.”

The Bois d’Arc project is one answer to a perennial question asked by water providers in Texas metros: Where will we find our future water source? Historically, they’ve eyed rural areas to fill that need, said Jim Blackburn, a Texas water expert and professor of environmental law at Rice University.

“It has been a priority for many, many decades in Texas for municipalities to be supplied with all the water they need in various and sundry ways, mainly though reservoirs and sometimes through groundwater development,” Blackburn said. “Historically, reservoirs have been located in rural areas and there’s no question that there’s been disproportionate impact.”

The Bois d’Arc project isn’t the only one where urban interests appear to be foisted on rural areas. The North Texas Municipal Water District is pursuing another major reservoir project in East Texas, called the Marvin Nichols Reservoir, where people’s homes and productive farmland will be flooded to make a lake. In Wichita Falls, city leaders are spearheading a hotly contested project to build a new reservoir in rural Clay County, despite an outcry from ranchers who stand to lose their property.

In Fannin County, public opinion seems divided on Bois d’Arc lake. County Commissioner Jerry Magnus, whose district includes the future reservoir, said he once was against the project. He’s since come around because of the anticipated economic benefit of having thousands of workers in the area and the possibility of tourism at the lake.

“It’s a boon to Fannin County as far as economic value because it’s gonna bring people who’ve got some money, and it takes money to make money,” Magnus said.

But Paul Vaughn, a farmer who was eating lunch at the senior citizen’s center in Bonham when I visited in June, said the Bois d’Arc project was simply a ploy to shift the cost of developing urban Texas to rural residents.

“In my personal opinion, the rich get richer and the poor get poorer all the time,” Vaughn said. “Fannin County isn’t gonna gain much off this lake for years to come. You can forget that.”

Either way, there’s nothing Witcher or other affected landowners can do to stop the project. The water district has the power of eminent domain, and he and other area landowners who stood to have their land flooded for the reservoir have unsuccessfully gone to court over the matter. Some of them have reached settlement agreements with the district, though they say they’re unable to speak on the confidential agreements.

Witcher says he and his wife plan to move from their home to property her family owns near Windom, about 20 miles away, this year. He says he’ll try to start his farming and ranching operation all over again from there—if he lives long enough to do it.

“Thing about it is I’m 68 years old,” Witcher said. “I don’t have a lot of productive time left to get a place back in production.”

More of these fights are expected to crop up as time goes on. By 2070, the state projects water demand to rise from 18.4 million acre-feet per year to 21.6 million. It also includes plans to build 26 new reservoirs, a strategy that some critics say is expensive, inefficient, and tends to disenfranchise rural people. Janice Bezanson, executive director of the Texas Conservation Alliance, a group that generally opposes new reservoir projects, notes that a significant portion of water used by households in suburban North Texas is used simply for landscape irrigation.

“We’re planning to spend billions of dollars, force people to sell land that provides their livelihoods . . . so we can build reservoirs so that people can water their lawns,” Bezanson said.

Rickman, the water district official, notes that Bois d’Arc Creek is only expected to meet the region’s future water needs through the year 2040. They’re already searching for new ways to bring water into the area, which may further impact surrounding rural counties.

“Even though we already have this reservoir online,” Rickman said, “we’re already looking for our next source of water because we know we’re going to continue to grow.”

This story was produced and published with KUT/Texas Standard.

If you’re interested in buying or selling land in Fannin County or north Texas, contact Troy Corman, with t2ranches.com at 214-690-9682 or email troy@t2ranches.com.

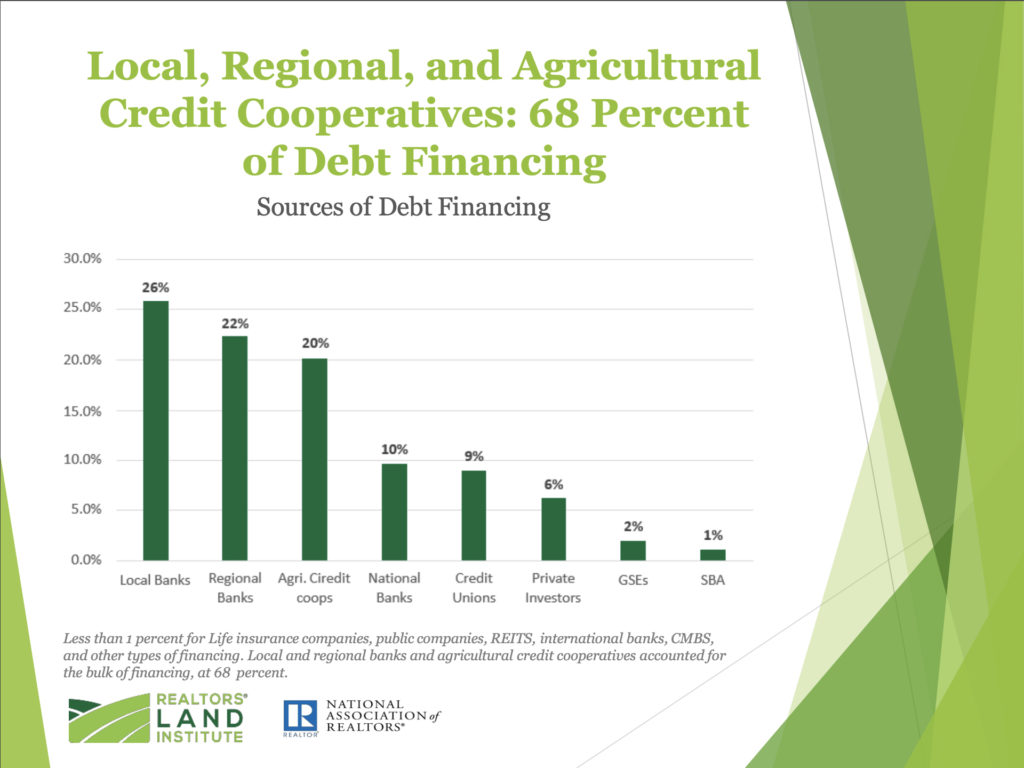

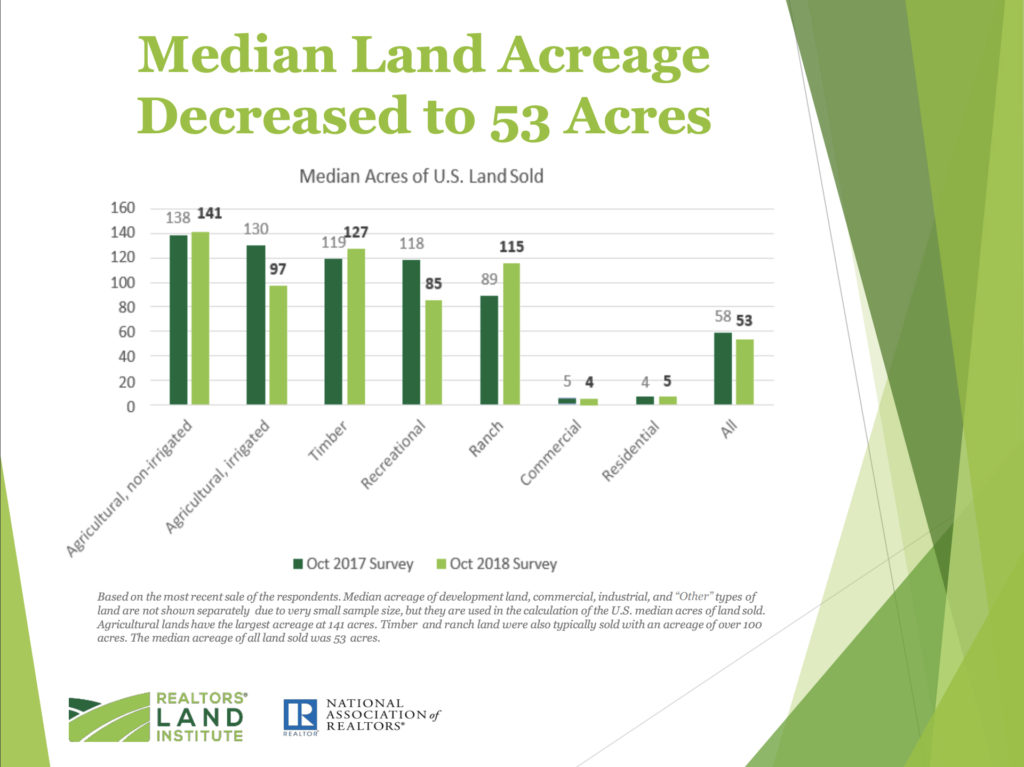

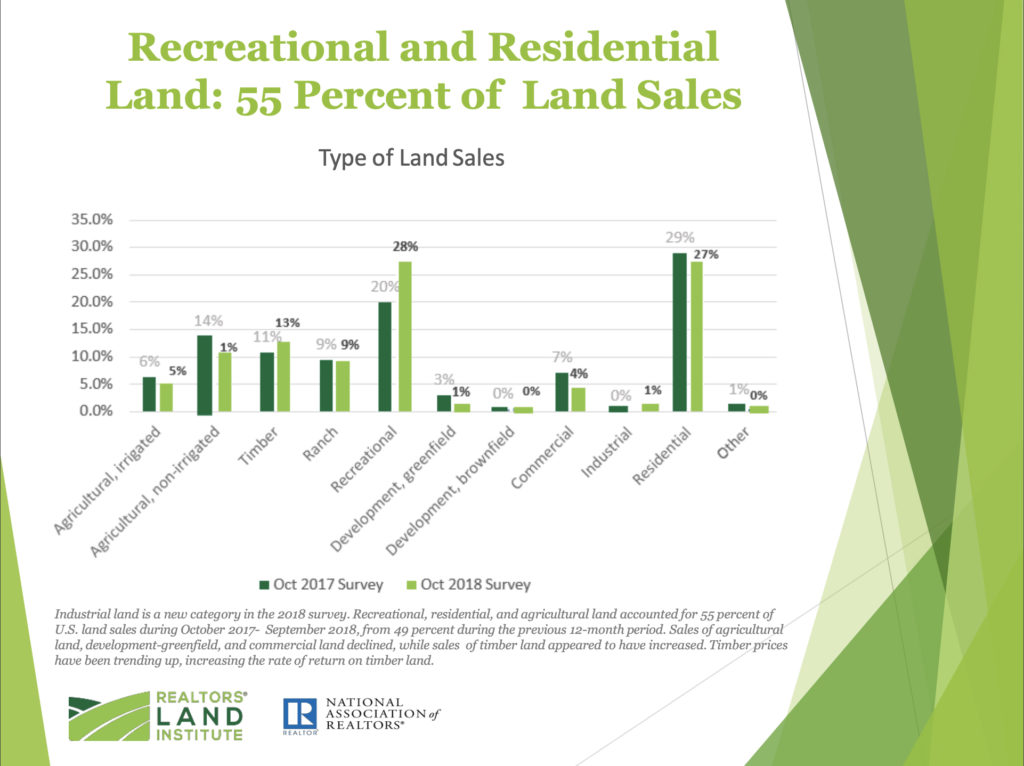

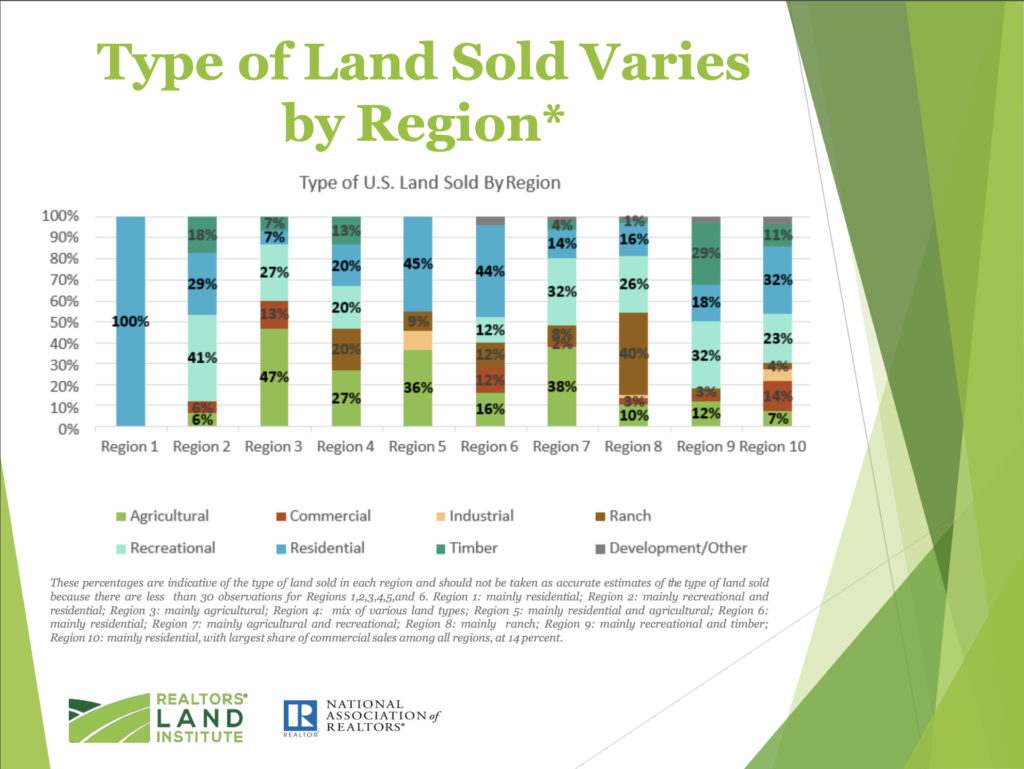

The big takeaways from the US land sales statistics in 2018 were that the Texas / Oklahoma region (Region 8) accounted for 23% of US land sales in 2018. As the Texas / Oklahoma region dominated land sales in 2018, they were reported in the following categories by market share.

I would suspect that commercial land and development land sales were under-reported since those categories are most often sold “off-market”, or often don’t have sales prices publicly reported in Texas.

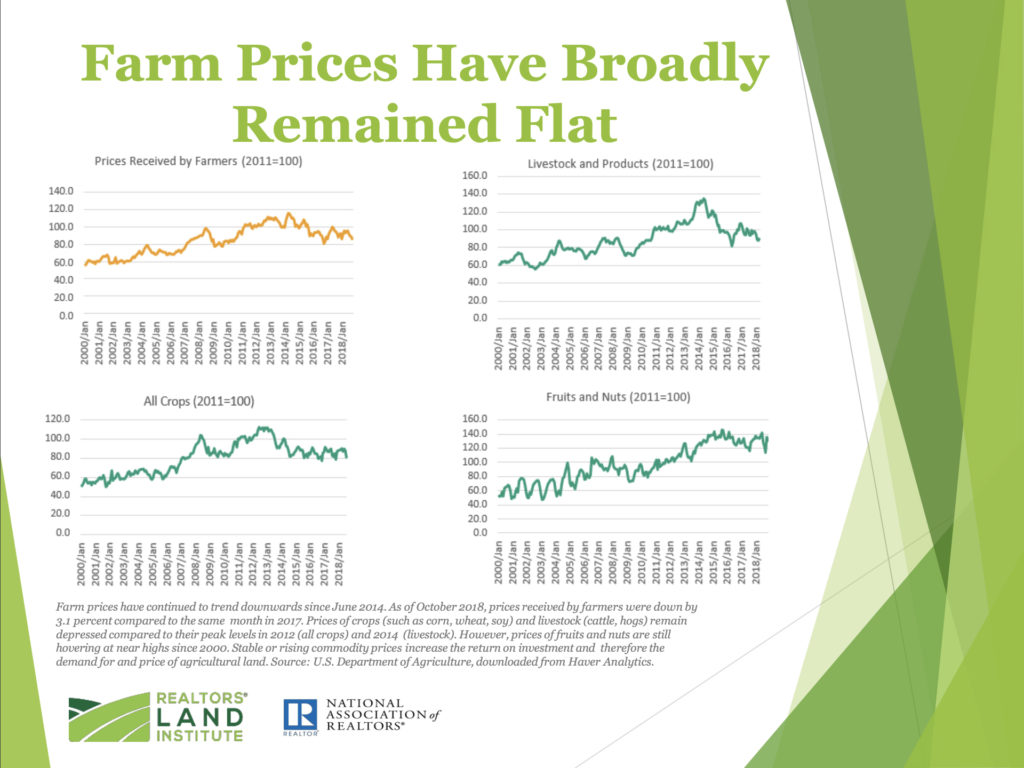

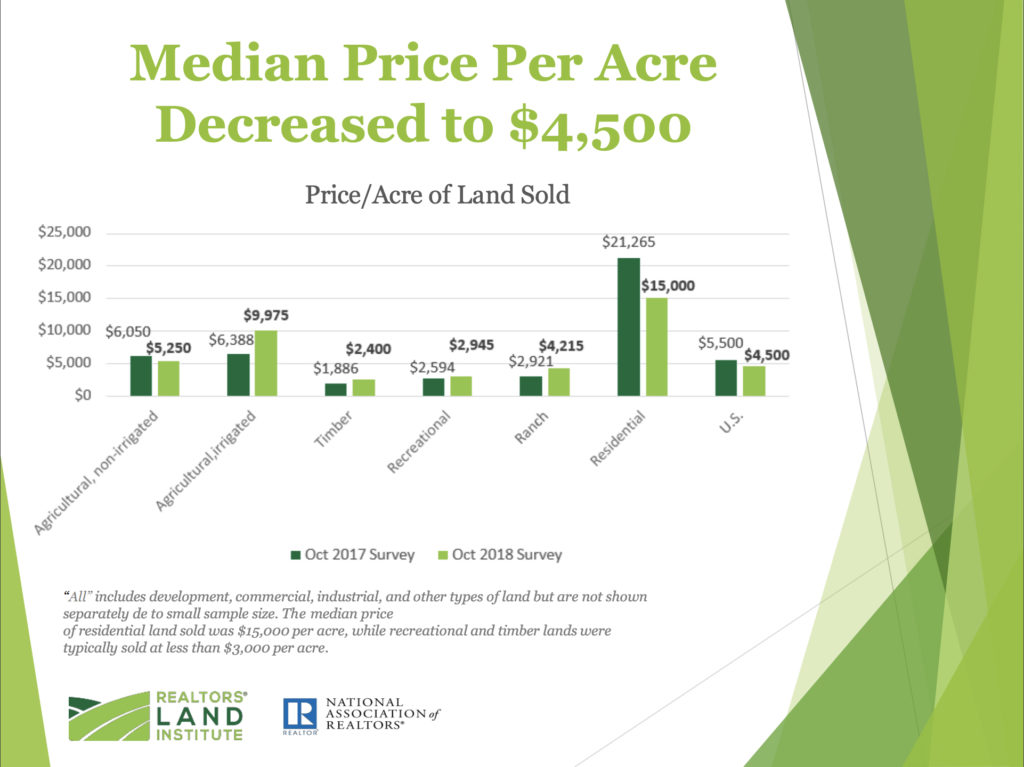

Other takeaways from the NAR Land Report for 2018 are that the average price per acre for all land sales averaged $4,500, declining from $5,500 in the 2017 report.

The categories enjoying the largest price increases included irrigated agricultural land rising from $6,388 and acre to $9,975 per acre – and ranch acreage rising from $2,921 an acre to $4,215 per acre.

Local banks were the leading lenders for land purchases that involved financing in 2018.

The average size of land sold per transaction declined to 53 acres.

If you would like more specific land price statistics in Texas, contact Troy Corman at troy@t2ranches.com.

Attached below are a few slides from the National Association of Realtors Land Report Sales Statistics for 2018.

A touching documentary on how man and wild beast bond to help US Veterans recover from combat.

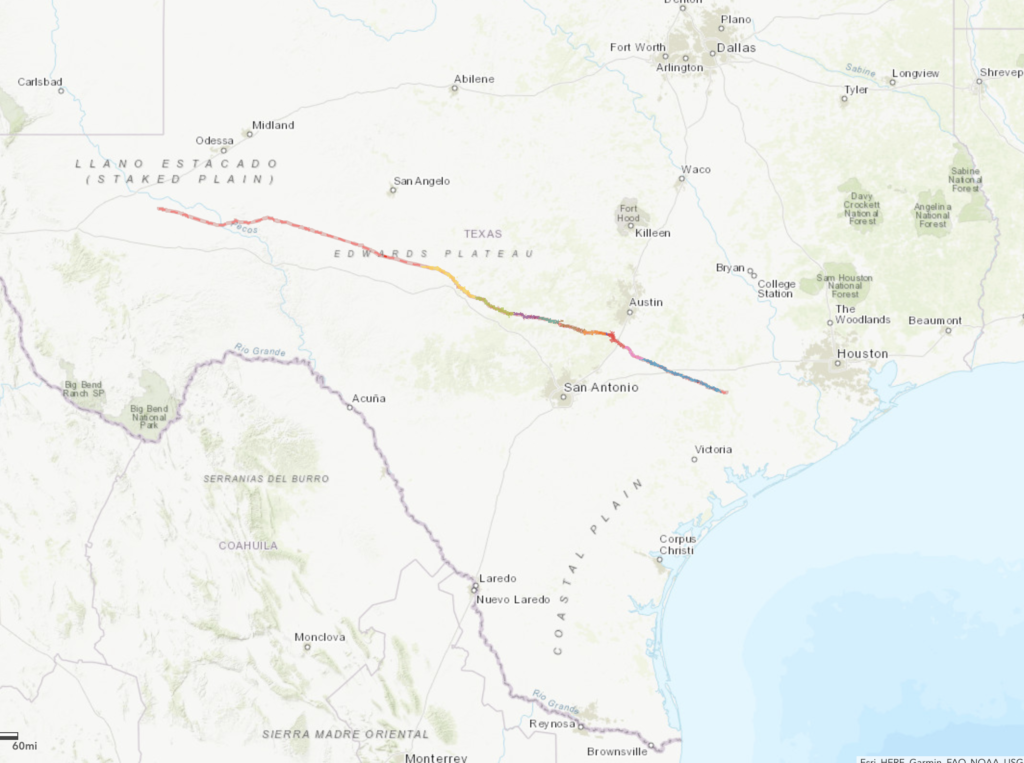

Conservative-leaning city governments and environmentalists are united in their opposition of the proposed route of pipeline giant Kinder Morgan’s 430-mile (690-kilometer), $2 billion natural gas expressway.

Known as the Kinder Morgan Permian Highway, the pipeline is designed to collect the natural gas that is captured when drilling for oil in the Permian Basin. A natural byproduct of oil drilling, currently the natural gas captured in the Permian, is often just burned off, a process known as flaring.

Many Ranchers and land owners in central Texas are up in arms over the proposed route of the 430-mile, $2 billion pipeline. If completed, the pipeline will deliver up to 2 billion cubic feet (56.6 million cubic meters) of natural gas — enough to fuel 31,500 homes for one day –as it passes through 16 Texas counties. Some of which would pass through beautiful Texas hill country land, including just south of Fredericksburg, and just north of Blanco, Texas. View the interactive map of the Kinder Morgan Permian Pipeliine here.

Opponents of the route have pointed to the potential contamination of the region’s porous Edwards Aquifer, the impact it would have on an environmentally sensitive area, and the lack of public engagement and oversight in the routing process.

Electric, telephone and water utilities must follow rules from the Texas Public Utility Commission. However, oil and gas companies do not need to seek the approval of the Texas Railroad Commission or affected municipalities for their proposed route. They also have no formal public process to hear from affected landowners.

Landowners in the pipeline’s path and their compadres opposing the proposed path, have held town halls, formed grassroots community campaigns, and lodged lawsuits against Kinder Morgan, as Kinder Morgan has exercised eminent domain to secure land along the proposed path.

A judge has ruled in favor of the Houston-based company in one legal challenge attempting to block the project on grounds that the Texas Railroad Commission doesn’t provide enough state oversight or regulation. That ruling is currently being appealed.

There is also concern that Kinder Morgan’s success would set a precedent for other companies interested in building conduits through the Hill Country, said Chuck Lesniak, who serves on an advisory committee for the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration.

“I do know that the industry is paying attention to this project, and the legal issues, because from a legal standpoint, if this goes south on Kinder Morgan, it has enormous impacts on other pipeline projects proposed for Texas,” Lesniak said.

It appears that according to this unofficial interactive map of the Permian Highway, that the route will go through a good stretch of Lavaca County.

If you’re interested in buying or selling land in Lavaca County in Texas, contact Troy Corman at 832-759-1523.

Above is a video narrated by Frank Price of Frank and Sims Price Ranch discussing a prescribed burn at their ranch northwest of San Angelo.

The Texas Wildfire Program is a grassroots effort led by the Texas A&M Forest Service. The idea is to allow ranchers and land owners create maps of their property that indicate which homes and buildings that they want most to protect against out of control wildfires. The Texas Wildfire Ranch Program will work with land owners to identify priority areas on the land that need to be most protected.

A mapping tool attached here, https://texasforestinfo.tamu.edu/mapmyproperty/ allows land owners to identify water sources, points of contact, sensitive areas, fences, gates, and other zones within the ranch to allow firefighters to make tactical decisions that reflect the landowners priorities.

The mapping tool allows land owners to create a map of their property and the ability to mark, draw and edit boundaries, circles, lines, points of interest, text labels, and export the map to a PDF file.

To map your ranch, visit Map My Property at: https://texasforestinfo.tamu.edu/mapmyproperty/.

The Texas Wildfire Ranch Program includes a joint effort by the following organizations:

• Texas and Southwestern Cattle Raisers Association®

• Texas A&M AgriLife Extension

• Texas Parks & Wildlife

• U.S. Fish & Wildlife Service

• United States Department Of Agriculture, Natural Resources Conservation Service

The video below has more information about the Texas Wildfire Ranch Program.

To learn more about prescribed burn techniques, visit https://t2ranches.com/stark-ranch-to-host-texas-am-agrilife-workshop-on-prescribed-burn-techniques

https://youtu.be/yQUJZd2gxok

By Troy Corman, t2ranches.com

As the low interest rate environment has continued following the Great Recession, most real asset prices have appreciated greatly, including recreational and agricultural land. Now, more than ever, it’s important to employ property tax reducing strategies to offset the higher property values. One way to do this on vacant raw land is to have the land legally deemed as Open Space (1-d-1) or Ag-use (1-d), as described in the Texas Constitution in Article VIII, Sections 1-d and 1-d-1. In this article, we will be discussing how Ag Use and Open Space land in Colorado County can qualify. If you would like to know how open space land and ag land designations work in your county in Texas, we will be happy to research and provide the answers.

The Open Space and Ag Use designations are special valuations that tax land on its agricultural use, or productivity value. There are specific requirements that must be met to qualify for either designation as detailed below.

Ag Use (1-d)

The land must be owned by a natural person. Partnerships, corporations or organizations may not qualify.

The land must have been in agricultural use for three years prior to claiming the Ag Use valuation.

The owner must apply for the designation each year and file a sworn statement about the use of the land.

The agricultural business must be the land owner’s primary occupation and source of income.

Open Space (1-d-1)

The land may be owned by an individual, corporation or partnership.

The land must be currently devoted principally to agricultural use to the degree of intensity generally accepted in the area.

The land must have been devoted to a qualifying use for at least five of the past seven years.

Agricultural businesses may not be the principal business of the owner.

Open Space is the most common designation. Keep in mind, both agricultural valuations have nothing to do with the market value of the land. Instead, the taxable value is based on the productivity value of the land. (PTC Sec. 23.52 Appraisal of Qualified Agricultural Land). One way to qualify for the Open Space valuation without having to wait for five years, is to have the land devoted principally to wildlife management, as defined in Subdivision (7)(B) or (C) to the degree of intensity generally accepted in the area, regardless of how the land was used in the preceding year. The caveat is that this is only allowed if your land is in an area with Federally Endangered Species, like the Golden-Cheeked Warbler, or the Black-Capped Verio.

Intensity Standards for Open Space Land

Intensity standards are derived from what is typical in the local area for the different agriculture operations. To qualify for Open Space land in Colorado County, the tract must have at least 70% to 75% agricultural use to qualify the entire tract, and must be used as such for a minimum of six months a year. The uses are defined in the following categories.

Cropland Operations

Row Crop

Orchard

Hay Crop

Truck Farm

Vineyards

Irrigated Cropland

Grazing Operations

Improved Pasture

Native Pasture

Brush Land

Wasteland

Special Operations

Dairy

Feedlot

Hop Operations

Bee/Honey

Permaculture

Floriculture

Domesticated Fowl

Christmas Trees

Aquaculture

Turf Grass Farm

Timber

Minimum Trees Per Acre Requirements

Pecan Orchards 14 trees/acre

Peach Orchards 40 trees/acre

Timber 400 trees/acre

Christmas Tree Farm 700 trees/acre

Minimum Acreage Requirements for Land

Native Pasture 10 Acres Minimum

Improved Pasture 10 Acres Minimum

Hay Production 10 Acres Minimum

Orchards/Vineyards 10 Acres Minimum

Tree Farms 10 Acres Minimum

Grass Farms 10 Acres Minimum

Irrigated Crop 10 Acres Minimum

Aquaculture 10 Acres Minimum

Previously, the minimum acreage was 6 acres, which is grandfathered in, but if you sell land or pass land on to heirs, the 10 acre minimum goes into effect.

Example of Tax Savings With Ag Use or Open Space Designations

In the following example we will consider a 15-acre tract of land in Colorado County appraised at $10,000 per acre, for a market value of $150,000.

Columbus ISD Tax Rate = $1.15/100 = .0115

Colorado County Tax Rate = $0.51/100 = .0051

CO Groundwater Conservation District = $0.01/100 = .0001

Total Tax Rate for the property is $1.67/100 = ./0167 ($1.67 per $100 of appraised value)

Without an Ag-use or open space use, this land would normally be taxed at $1.67 x $150,000 (the appraised value in this example) resulting in a property tax bill of $2,505.

If this same 15 acres was classified as “Ag Exemption” based on cattle grazing (Native Pastureland as the category), you would multiply the $150,000 x $98 (Colorado County appraisal district ag value for native pastureland). The result would equal $1,470.

Now the annual property tax would be calculated multiplying the $1,470 x .0167 (tax rate of $1.67/100), to arrive at a property tax bill of $24.55. That’s quite a difference!

How to Get Your Land an Ag Exemption in Colorado County

The new property owner(s) must apply for the Ag Exemption and must have owned the property on January 1 of the tax year. The property must have had an ag exemption in the previous tax year and must be at least 10 acres. Once the property transfers to the new owner(s), the Appraisal District must send them an application to continue the ag exemption.

If the property is bought after January 1 in which the previous ag exemption is in place, the new owner will keep the benefit of the ag exemption for that tax year.

For an existing land owner that has never received an “Ag Exemption”, the land must measure at least 10 acres, must be currently devoted principally to agriculture use to the generally accepted standards for the county, and must have established agricultural use for five out of the preceding seven years. An ag application must be filed with the district with the Chief Appraiser before ag is granted or denied (PCTS Sec. 23.54. Application)

The 1D1 Open-Space Valuation (Ag Exemption) application is due before May 1st.

Beekeeping is Now a Qualified Ag Exemption for Tracts as Small as 5 Acres

On January 1, 2012, Texas law made is possible for beekeeping to qualify as an ag exemption on property taxes. The details can be found in the Texas Property Tax Code under chapter 23, Subchapter D, Sec. 23.51 (1) and: (2) “… the term also includes the use of land to raise or keep bees for pollination for the production of human food or other tangible products having a commercial value, provided that the land used is not less than 5 acres or more than 20 acres. The Colorado County Appraisal District allows for pollinating-solitary Nesting Bees (typically Mason Bees – bees of pollination) or Honey Bees (production of human food).

Under Open-Space productivity valuation, values are calculated using a modified income approach to determine the value per acre.

In Texas, one hive is estimated to produce 74 pounds of honey, with an estimated $60 of expenses per hive. Utilizing the five-year average of $5.08 per pound of honey, Colorado County calculates the Beekeeping valuation as follows:

5 acres – must have 6 hives or nesting boxes

6 – 10 acres – must have 7 hives or nesting boxes

11 – 12 acres – must have 8 hives or nesting boxes

13 – 14 acres – must have 9 hives or nesting boxes

15 – 16 acres – must have 10 hives or nesting boxes

17 – 18 acres – must have 11 hives or nesting boxes

19 – 20 acres – must have 12 hives or nesting boxes

How to Qualify for Wildlife Management Use for an Open-Space Agricultural Valuation to Reduce Your Property Taxes in Texas

To qualify for Wildlife Management Use, the land must have been qualified as Ag Open Space use previously for at least one year. The land must have been used in at least three of the following ways to propagate a sustaining breeding, migrating, or wintering population of indigenous wild animals for human use, including food, medicine, or recreation:

If the new owner has subdivided the land out of a larger tract, then the tract must be a minimum of 16 acres to qualify as Wildlife Management Use. The new owner can wait one year under ag exemption, and then switch to Wildlife Management use.

If the tract had Wildlife Management use in the previous year, and meets the minimum 10 acres for Ag Exemption, then the new owner can continue using Wildlife Management use but a new 1D1 Ag Application must be submitted along with a Wildlife Management Plan. The Wildlife Management Plan can be on the Texas Parks and Wildlife Form 885, or can be a self-written plan, but it must include three out of the seven wildlife practices listed above with a list of targeted wildlife species.

It is recommended that you provide a map of where the three practices are located on your land. In addition, keep your receipts for your expenses incurred as a result of actively maintaining the three out of seven wildlife management practices. Ideally, you will want to contact your local Texas Parks and Wildlife (TPWD) Biologist prior to filling out the wildlife management plan. The Biologist can also advise you on what wildlife is conducive to your particular property.

Ag Rollback Taxes in Texas

Be aware that if you sell land that has either the Ag Use or Open Space designation, rollback taxes could be triggered. An Ag Rollback Tax is an additional tax that is imposed when a property owner changes the use of a property from Agricultural to any other use – excluding building a house for a personal homestead. The Rollback Tax recoups the tax the owner would have paid if his or her land had been taxed at Market Value for the years covered in the Rollback (generally five years).

Under Ag Use (1-D), sale of the land or the change of use in the land creates the Rollback Tax which extends back to the three years prior to the year in which the sale or change in use occurs.

Under Open Space (1-D-1), the Rollback Taxes are triggered when the change in use is for a nonagricultural purpose, with taxes rolled back to recapture the previous five years of taxes that would have been paid had the land not had the Open Space designation.

If you have any questions regarding any details in this article, or need additional information, please contact Troy Corman, founder of t2 Ranches, at 832-759-1523 or 214-690-9682.

Our professional staff is passionate about our clients’ goals, and aim to treat each client as if they were our only one. Together, your next real estate experience will not only be enjoyable but also produce great results! Please feel free to give us a call, or send an email anytime and we will contact you as soon as possible.