Below are the top land owners in the US based on acreage.

50. Hadley Family: 260,000 acres together with the large Diamond A Ranch. Heirs to the Anheuser-Busch beer empire,

49. Lyda Family: 260,035 acres, together with La Escalera ranch in far West Texas. Cattle ranchers.

48. Galt Family: 262,000 acres in Montana, together with the Martinsdale Ranch. Cattle ranchers.

47. Anne Marion: 275,000 acres in Texas, together with the well-known 6666, or “4 Sixes” cattle ranch within the Southern Panhandle.

46. Lee Family: 275,000 acres in New Mexico. Sheep and cattle ranchers who owe a few of their wealth to the invention of uranium and coal on their property.

45. Babbitt heirs: 275,000 acres in Arizona. Cattle ranchers.

44. Killam Family 277,000 acres, largely in Texas and Oregon. Oil operations in Louisiana, Nebraska, Kansas, Arkansas, and Texas.

43. Kokernot heirs: 278,000 acres in West Texas. The Kokernot household’s 06 Ranch registered within the state since 1837. Leoncita Cattle Co.

42. Fasken Family: 279,128 acres in Texas. David Fasken, a Canadian, purchased a ranch in West Texas in 1913. Fasken Oil & Ranch, a significant oil drilling company was born when oil was discovered on the ranch.

41. Collier Family: 280,000 acres, primarily in Collier County, Florida. Baron Collier, who developed land and infrastructure in southern Florida, had been largest landholder in Florida.

40. Bass Family: 285,000 acres in Texas. Business interests have expanded from oil and cattle ranching.

39. Barta Family: 286,000 acres in Nebraska. The Bartas created their wealth from their prescription providers firm, Sav-Rx. Owns one of many largest cattle ranching operations within the state.

38. Llano Companions: 295,000 acres in New Mexico, Texas and Florida. Ranch operators.

37. Mike Smith: 295,980 acres in Texas. His properties embrace the 11,830 Broseco Ranch, which accommodates two lakes which can be 100 acres in dimension.

36. Robinson & Freed households: 300,000 acres in Utah. Includes six cattle ranches.

35. Shannon Kizer: 302,000 acres in Arizona, Colorado, New Mexico, Oklahoma, and Texas. Kizer has farming and ranching operations that produce peanuts, corn, wheat, dairy, and cattle.

34. Collins Family: 311,395 acres in Northern California and western Pennsylvania. Operators of a long-time lumber enterprise.

33. Stefan Soloviev: 325,077 acres in New Mexico, Kansas and Texas. Soloviev makes use of the land to develop crops like wheat, corn, and sorghum.

32. Malone Mitchell III: 336,000 acres in Texas. Malone Mitchell runs Longfellow Ranches, a 500 sq. mile hunting ranch.

31. Zane & Tanya Kiehne: 345,000 acres in New Mexico and Texas. The couple are ranch operators.

30. Hughes Family: 390,000 acres in Texas. Oil enterprise.

29. Holding Family: 395,030 acres in Montana. Descendants from the Sinclair Oil empire.

28. Jeff Bezos: 420,000 acres in Texas. Bezos is cofounder of Amazon.

27. Philip Anschutz: 434,500 acres in Wyoming and Colorado. In Wyoming, he plans to build 1,000 turbines, each of them 262 feet high, along with a 730-mile power line to get electricity to California.

26. Fisher household: 440,000 acres in California. 440,000 acres in California. The property is mainly timberland. Owners Donald and Doris Fisher co-founded the clothing brand Gap.

25. Simplot Family: 443,091 acres in Idaho. Assembled by Jack Simplot, who first provided McDonald’s with french fries.

24. McDonald household: 474,000 acres in Alabama, Florida, and Oklahoma. Land is used for timber, sand and gravel, and oil.

23. D.R. Horton: 503,000 acres in New Mexico and Texas, the place he hosts a kids’s summer season camp. He operates a ranch and kids’s summer season camp.

22. Westervelt heirs: 518,000 acres in Alabama, Mississippi, and Virginia. Focused on renewable power, lumber and wildlife.

21. Holland Ware: 534,900 acres in Florida and Georgia. Most of Ware’s holdings are managed by the Holland M. Ware Charitable Basis, which helps a number of causes, including animal welfare.

20. Stimson Family: 552,000 acres in Montana and Oregon. Lumber enterprise.

19. Martin Family: 570,000 acres in Louisiana. Long-time lumber enterprise.

18. Ford Family: 580,000 acres in Oregon. Timber.

17. Thomas Peterffy: 581,000 acres in Florida. Peterffy, a refugee from Hungary, made his fortunes as an investor.

16. O’Connor heirs: 587,800 acres in Texas. Oil pursuits.

15. Hamer Family: 600,000 acres in West Virginia. The household harvests hardwood timber from the land.

14. Lykes heirs: 615,000 acres in Texas. The household raises cattle and grows citrus in Florida.

13. Briscoe heirs: 640,000 acres in Texas. The mixed landholdings belonged to former Texas governor, the late Dolph Briscoe Jr.

12. Wilks Brothers: 702,367 acres in Montana, Idaho, Oregon, Tennessee, and Texas. Brothers Farris and Dan Wilks began off with Frac Tech, a pure gasoline extraction firm in 2002, and bought it for $3.5 billion in 2011. Since then, they’ve been buying land.

11. Pingree heirs: 830,000 acres in Maine. Long-time lumber firm.

10. King Ranch heirs: 911,215 acres in Texas. The property is the biggest ranch in Texas.

9. Peter Buck: 925,000 acres in Maine.

8. Singleton Family: 1.1 million acres in New Mexico and California.

7. Brad Kelley: 1.2 million acres in Kentucky. Kelley’s funding group owns and runs the 762-acre Calumet Farm, which produces Kentucky Derby and Triple Crown winners.

6. Irving Family: 1.2 million acres in Maine. Business interests include lumber, newspapers, and petrochemicals companies.

5. Stan Kroenke: 1.4 million acres in Montana and Wyoming. The actual property mogul can also be proprietor of the Los Angeles Rams and married to Ann Walton Kroenke, an heiress to the Wal-Mart fortune. Owns the Waggoner Ranch.

4. Reed Family: 1.7 million acres Washington, Oregon, and California. Family members own a long-time logging firm, Green Diamond Resource Co.

3. Emmerson Family: 2 million acres in California and Washington. Relations run Sierra Pacific Industries, a log enterprise that depends on lumber from forest fires and sells it to lumber retailers.

2. Ted Turner: 2 million acres in New Mexico, South Dakota, Nebraska, and Georgia. Turner’s land is utilized by greater than 50,000 head of buffalo for grazing – the biggest non-public herd of bison on the earth.

1. John Malone: 2.2 million acres in Maine, New Mexico, Colorado, and Wyoming. Malone, the biggest non-public landowner in America and who made his fortune within the telecom enterprise, and runs profitable cattle ranches.

GOLIAD – In a dense South Texas thicket of mesquite and grass, a small herd of wild antelope known as nyala is grazing serenely when an all-terrain vehicle comes to a stop on the dirt path.

GOLIAD – In a dense South Texas thicket of mesquite and grass, a small herd of wild antelope known as nyala is grazing serenely when an all-terrain vehicle comes to a stop on the dirt path.

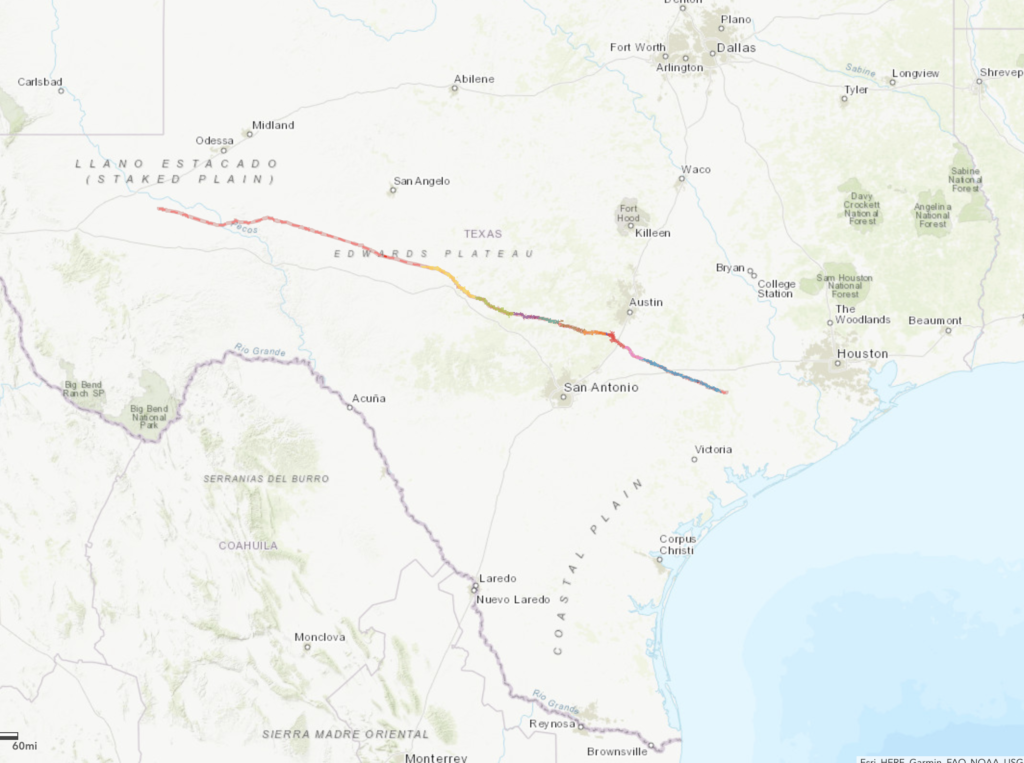

Chronic Wasting Disease or CWD, is a progressive neurological disease that can affect white-tailed deer, black-tailed deer, mule deer, elk, red deer, reindeer, sika and moose. Once infected, it can take two to four years for symptoms to appear – such as weight loss, drooling, stumbling and stupor.

Chronic Wasting Disease or CWD, is a progressive neurological disease that can affect white-tailed deer, black-tailed deer, mule deer, elk, red deer, reindeer, sika and moose. Once infected, it can take two to four years for symptoms to appear – such as weight loss, drooling, stumbling and stupor.